Things You Need to Know About the Hire Purchase Moratorium

- Truck Venture

- May 2, 2020

- 3 min read

In a media briefing, BNM officials said that there is a confusion on the procedures for the six-month loan moratorium and it’s not a U-turn or revocation of earlier directive. In any event, BNM has clarified that interest will be accrued on the loan product during the loan moratorium period.

Well, there is no point to dwell on the confusion and dispute whether it’s a U-turn or not. Let’s look at the position as it stands now.

First, what is a Hire Purchase Moratorium?

It is a temporary deferment or suspension of Hire Purchase payment obligation for a limited period of time. During this period, customers with HP facility that meet the eligibility criteria are given the option to apply for Moratorium not to make any payment.

Who are eligible?

i. All individuals, small and medium-enterprise (SME); and

ii. HP facilities that are not in arrears exceeding 90 days as at 1 April 2020.

Do I need to apply for deferment and how long is the deferment?

Yes. You have to submit your Consent Form to the Bank for you TO OPT-IN for the Moratorium. The deferment period is from 1 April 2020 to 30 September 2020 i.e. six (6) months.

And here comes the ultimate question - Do I have to pay interest or any charges on the deferred installments?

During the Moratorium period, there will be no interest on the deferred installments. After the Moratorium period, the prevailing Annual Percentage Rate (APR) as stated in your existing HP Agreement will be charged on the deferred installments. Any interest on the deferred installments will commence from October 2020 onwards until the deferred amount is settled.

It has been really confusing if we just refer to the official statement released by the bank without looking at the calculation.

Simply put, there is no interest on interest, like the way how bank charges on the delay in credit card payment. But it doesn’t mean the accrued sum is interest free! When you defer your 6-month installment, you are like refinancing your 6 months’ installment. Interest will be charged on ‘refinanced amount’ and spread across the remaining tenure of your loan period.

The formula is:

<Deferred Amount> x <Interest Per Annum> x <how many years the balance of loan period is>

Illustration:

Monthly Repayment = RM1,000

Total Amount Deferred for 6 months = RM6,000

Interest Chargeable (APR) = 3.5%

Total Interest Charged on Deferment = RM1,470

Why is it RM1,470?

Because RM6,000 x 3.5% x 7 years (the balance loan period)

The moratorium only provides relief for the 6 months’ period, but since there is a delay in recovering deferred amount. Hence it is not difficult to understand why the interest chargeable for the entire period in so long the amount is outstanding.

Some said why not just paid in one lump sum before October 2020 to avoid rolling interest gets chargeable. Yes, they are right in doing so provided you can fork out the one lump sum.

Who would bear the additional cost and long term effect of the 6 months’ capital cost?

Whilst BNM reduced the statutory reserve requirement to shore up the bank’s liquidity, the delay in paying back the deferred amount comes with a cost too. It’s not difficult to understand the formula above. Otherwise, who will bear the cost besides the borrower?

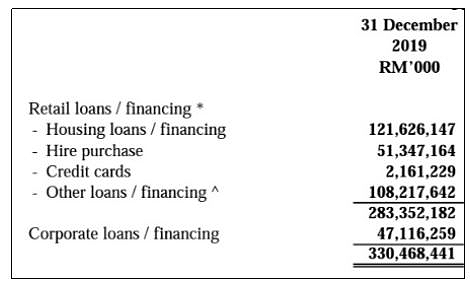

For example, Public Bank which is in Bucket 1 of the Domestic Systemically Important Banks. The spread of loan composition is as follows. Hire Purchase loan is the second largest asset in bank’s book. If the bank were to waive the interest all together, the effect on bank’s profit is far beyond what we expect.

For more information on Public Bank Moratorium, you may refer to the FAQ below or their official website.

Is it worth to take up the moratorium?

In times of difficulty, you really have no choice but to defer the installment to keep the business afloat. Most SMEs, especially startup companies, are operating via financing from the bank which is the common course of funding to begin a business.

There is no right and wrong. If you are cash rich, no point keeping the money in fixed deposit which barely gives you a rate of 2.55% - 2.85% p.a. Just continue with the installment or pay a one lump sum before October 2020.

However, if your company is not a net-cash company and have other payment obligations to meet. My take is that:

Keep cash to ensure the expenses are paid and well managed, and to await for business opportunity which may come unexpectedly and in need of cashflow.

We really don’t know how long the recession would take and how soon the economy can recover. The lock-down / MCO is unprecedented. Cash is king. Keeping enough cash will last you for the winter where everyone is starved and hungry.

Disclaimer: Above-mentioned is my personal opinion and does not represent any personal finance or investment advice to you.

Comments